- 604-929-7090

- reception@cvbc.ca

All CVBC registrants in the Private Practice, Specialty Private Practice and Public Sector classes, including those with Provisional or Provisional Supervised registration, as of April 14, 2025.

The special fee must be paid in full on or before June 13, 2025.

Every registrant who is subject to the special fee will receive an invoice by April 15, 2025 which will be available within their Online Registrant Account.

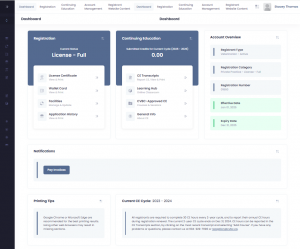

Log in to your registrant account by following this link or by using the Portal Login on the CVBC website. The invoice can be found on the main page of your online account, and is accessible by clicking on the “Pay Invoices” button under the heading “Notifications”.

Retired, Non-Practicing and Temporary registrants of the CVBC are not subject to the special fee. However, if they transfer into a class that is subject to the fee at any time during the assessment period (April 14, 2025 through April 13, 2026), they will be required to pay the special fee as part of their transfer process.

Anyone applying for registration in the Private Practice, Specialty Private Practice or Public Sector classes will be subject to the special fee upon registration.

Every registrant who is in one of the affected classes of registration as of April 14, 2025 must pay the special fee.

If a registrant applies to transfer to an inactive class or to resign their registration and their special fee is still outstanding, the CVBC will deduct the amount owing to the CVBC from any registration fee refund that would otherwise be issued to the transferring registrant.

No. The special fee is non-refundable.

No. The full amount of the special fee will be assessed during the entire assessment period, being April 14, 2025 to April 13, 2026, inclusive.

No. A registrant will pay the special fee only once.

A complete explanation is found here.

In summary, registrants have declined to raise fees since 2011. Inflation alone has increased the cost of goods and services by over 38% since 2011. The CVBC is legislated under the Veterinarians Act to regulate veterinarians and the delivery of veterinary medicine in the public interest. The duties that the CVBC is required by law to discharge are not discretionary; accordingly, the CVBC must have the financial resources to discharge its duties. Without the special fee, the CVBC would have faced a liquidity crisis by June 2025 and would have become insolvent soon thereafter.

Pursuant to s 28(1) of the Veterinarians Act, if the Minister of Agriculture and Food considers it to be in the public interest, the Minister may by order make a new bylaw. Pursuant to Ministerial Order No. M88, the Minister has ordered the special fee.

The consequences of a failure to pay the special fee are contemplated across sections 1.79 [Definitions], 1.83 [Failure to pay other fees, assessments, fines or costs by due date], and 2.27 [registration renewal] of the CVBC Bylaws.

Pursuant to section 1.83, the College’s Council has authority to direct payment of a late fee in an amount up to 25% of the unpaid amount of the special fee and/or the cancellation of the registrant’s registration.

Notwithstanding the above, failure to pay the special fee will result in the special fee becoming an “outstanding fee, special fee or assessment” and a debt owed by the registrant to the College as contemplated in section 2.27(1)(c) of the Bylaws. Pursuant to section 2.27(3), if the outstanding amount or debt is not paid by the end of the registration year, then the registrar is required to cancel the registration of the registrant.